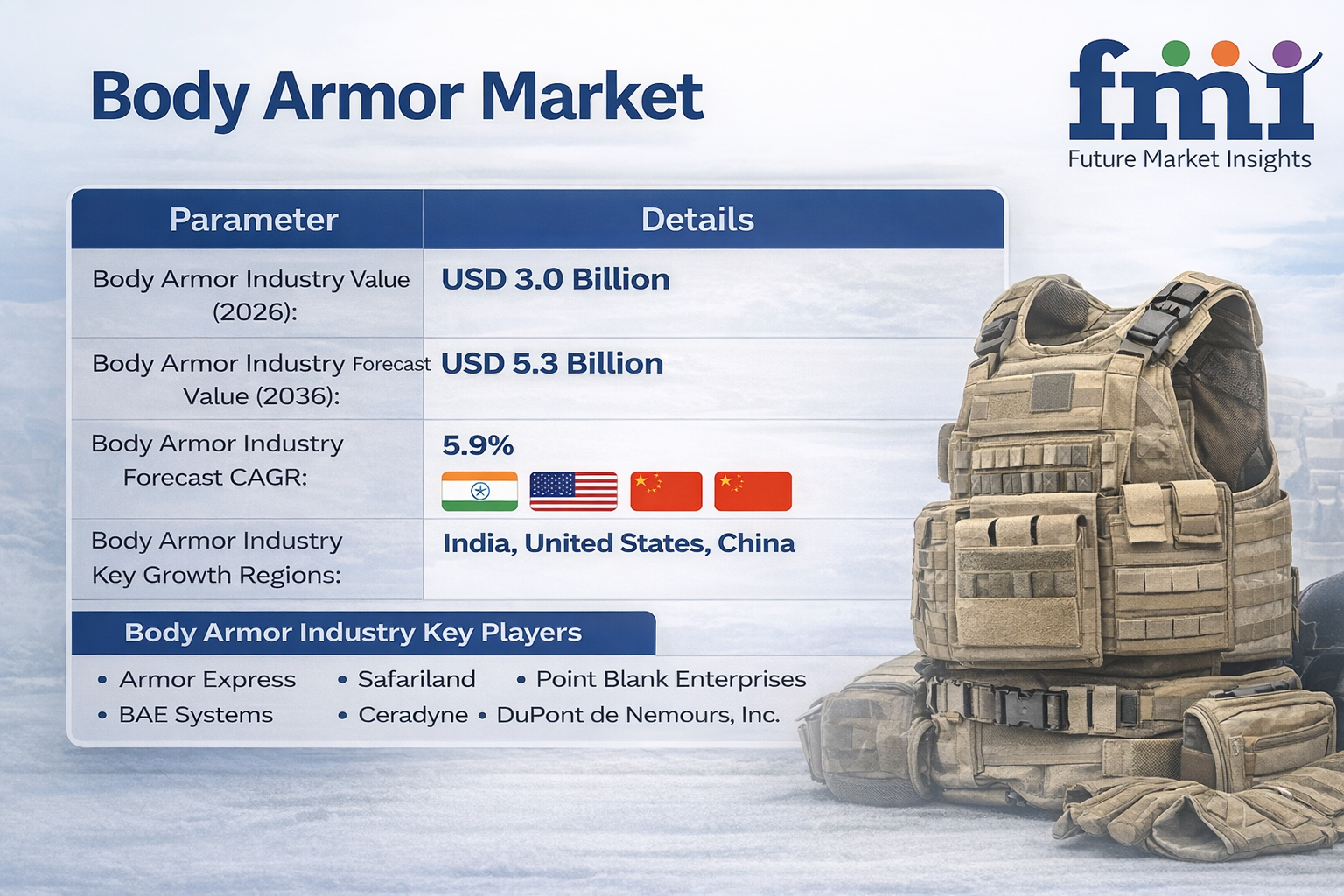

Global Body Armor Market Poised to Exceed USD 5.3 Billion by 2036 as Modular Protection Systems Gain Momentum

Rising defense modernization programs, lightweight ballistic materials, and scalable vest adoption drive sustained industry expansion at a 5.9% CAGR.

NEWARK, DE / ACCESS Newswire / February 13, 2026 / The global defense and security landscape is entering a new era of advanced personal protection. Driven by rising geopolitical tensions, modernization of infantry gear, and growing demand for lightweight tactical equipment, the Body Armor Market is projected to expand from USD 3.0 billion in 2026 to more than USD 5.3 billion by 2036, registering a steady CAGR of 5.9% during the forecast period.

According to the latest industry outlook by Future Market Insights (FMI), defense agencies worldwide are increasingly transitioning from traditional heavy armor systems to modular scalable vests (MSVs), enabling personnel to customize protection levels based on operational threat assessments while improving mobility and endurance.

The Shift Toward Modular Protection: Beyond Traditional Armor

For decades, body armor development focused primarily on maximizing ballistic resistance. In 2026, the industry narrative has evolved. Modern military and law enforcement strategies now emphasize mission-adaptive protection that combines survivability, comfort, and agility.

Industry analysts note that balancing NIJ Level IV protection standards with a target system weight below 10 kilograms has become one of the sector's most significant engineering challenges. This pressure is accelerating adoption of advanced materials such as ultra-high-molecular-weight polyethylene (UHMWPE), ceramic composites, and next-generation aramid fibers.

The transition toward scalable protection is creating new opportunities across product categories, especially in modular vests that allow operators to configure soft and hard armor inserts depending on threat scenarios.

Engineering Innovation: Material Science as the Industry Backbone

Manufacturers are increasingly treating body armor as a comprehensive protection ecosystem rather than a standalone product. Key engineering priorities include:

Weight Reduction Without Compromise: Maintaining ballistic integrity while improving soldier mobility.

Thermal Management: Cooling systems integrated into carriers for tropical combat zones.

Ergonomic Design: Gender-specific cuts, breathable fabrics, and moisture control to increase wearability during long deployments.

Supply Chain Security: Vertical integration strategies to ensure stable access to critical fibers and ceramics.

Defense contracts-typically fixed-price multi-year agreements-make raw material volatility a central concern. Suppliers are pursuing long-term fiber agreements and internalizing material production to protect profitability against petrochemical price fluctuations.

Segment Leadership: Why Vests Continue to Dominate

Vests remain the cornerstone of personal ballistic protection, accounting for 55.4% of market share in 2026. Their dominance stems from their ability to function as modular platforms capable of integrating soft panels, hard plates, tactical accessories, and smart technologies.

Continuous textile innovation has improved durability while enabling carriers to handle heavier operational loads. As military procurement increasingly prioritizes survivability and adaptability, demand for advanced vest systems is expected to remain strong throughout the forecast period.

Defense & Security Personnel: The Core Revenue Stream

Defense and security applications account for approximately 52% of industry revenue, driven by large-scale government procurement programs. National militaries and law enforcement agencies require certified equipment capable of withstanding high-velocity rifle threats while maintaining operational flexibility.

The scale of these contracts supports long-term revenue stability for suppliers, especially through Indefinite Delivery/Indefinite Quantity (IDIQ) agreements that span several years and encourage ecosystem-based upselling through accessories and replacement components.

Regional Performance: India Leads Growth, Global Adoption Accelerates

While global demand is rising, adoption patterns vary significantly across major nations:

India (7.0% CAGR): Defense modernization and "Atmanirbhar Bharat" initiatives are boosting domestic manufacturing and reducing reliance on imports.

United States (6.8% CAGR): Ongoing upgrades to modular scalable vests and strong defense budgets continue to drive innovation and procurement.

China (6.8% CAGR): Expansion of modernization programs and internal security requirements support strong industry momentum.

Japan (6.5% CAGR): Increased investment in lightweight defense equipment and regional security preparedness fuels demand.

Germany (6.4% CAGR): Defense spending reforms and NATO interoperability requirements sustain steady market growth.

Emerging Trends Reshaping the Industry

Several macro trends are defining the future of ballistic protection:

Integration of smart textiles and wearable electronics that transform armor into data-enabled platforms.

Development of nano-material composites for improved protection-to-weight ratios.

Rising civilian and law enforcement demand for discreet, dual-threat protection.

Acquisition of ceramic manufacturers to secure supply chains for hard armor plates.

Sustainability initiatives focused on recycling expired protective gear.

These trends collectively indicate a shift from product-focused competition toward integrated personal protection ecosystems.

Competitive Landscape: Innovation and Vertical Integration

The market remains highly competitive, with leading manufacturers investing aggressively in process optimization, proprietary materials, and ecosystem-based solutions. Major participants include:

Armor Express

Safariland

Point Blank Enterprises

BAE Systems

Ceradyne

DuPont de Nemours, Inc.

Honeywell International Inc.

USA Armor Corporation

Heckler & Koch Defense

LUPU

Industry consolidation remains active, as larger defense firms acquire niche armor manufacturers to strengthen vertically integrated supply chains and secure long-term government contracts.

The Outlook: Protection Systems Become Strategic Infrastructure

By 2036, body armor is expected to evolve from a standalone protective item into an intelligent, modular platform integral to modern soldier systems. As defense agencies emphasize mobility, survivability, and digital integration, the market will continue shifting toward lighter, smarter, and more adaptable solutions.

FMI analysts conclude that manufacturers capable of combining advanced materials, ergonomic design, and secure supply chain strategies will define the next decade of innovation in global personal protection.

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Body Armor Market through 2036, visit the official report page at: https://www.futuremarketinsights.com/reports/body-armor-market

Related Reports:

Body Tape Market : https://www.futuremarketinsights.com/reports/body-tape-market

Body Firming Creams Market: https://www.futuremarketinsights.com/reports/body-firming-creams-market

Body Fat Measurement Market : https://www.futuremarketinsights.com/reports/body-fat-measurement-market

Body Luminizer Market : https://www.futuremarketinsights.com/reports/body-luminizer-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - [email protected]

For Media - [email protected]

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]