Global Dynamic Positioning System Market to Surpass USD 365.2 Billion by 2036 | Future Market Insights, Inc.

Rising Offshore Automation, Safety Mandates, and Precision Navigation Needs Redefine Vessel Positioning Worldwide

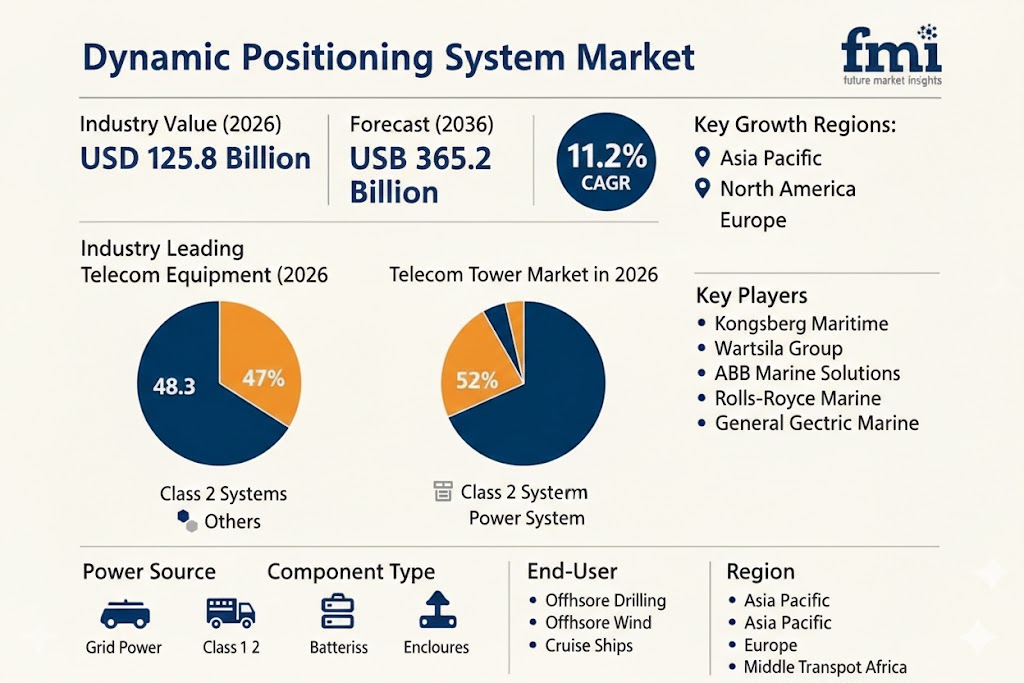

NEWARK, DELAWARE / ACCESS Newswire / February 9, 2026 / The global maritime and offshore industries are entering a decisive phase of automation-led transformation. As offshore energy projects move into deeper waters and vessel operators demand higher precision, safety, and uptime, the Dynamic Positioning System (DPS) Market valued at USD 125.8 billion in 2026 is projected to surge to USD 365.2 billion by 2036, expanding at a robust CAGR of 11.2%, according to Future Market Insights (FMI).

This growth reflects a structural shift rather than a cyclical rebound. Dynamic positioning systems are no longer viewed as optional navigation aids; they are becoming mission-critical infrastructure for offshore wind deployment, deepwater oil & gas operations, subsea construction, and increasingly, automated and reduced-crew vessels.

Market Analysis: Dynamic Positioning Systems (2026-2036)

Category | Market Detail |

|---|---|

Industry Value (2026) | USD 125.8 Billion |

Forecast Value (2036) | USD 365.2 Billion |

Forecast CAGR | 11.2% |

Leading Equipment | Class 2 Systems (48.3% Market Share) |

Key Growth Regions | Asia Pacific, North America, Europe |

Key Industry Players | Kongsberg Maritime, Wartsila Group, ABB Marine Solutions, Rolls-Royce Marine, General Electric Marine |

Precision Becomes a Strategic Imperative

Dynamic positioning systems enable vessels to maintain exact position and heading without anchoring, even under extreme wind, wave, and current conditions. In 2026, rising offshore complexity is elevating performance expectations across commercial and energy fleets.

Operators are prioritizing systems that deliver:

Continuous station keeping under variable sea states

Fault tolerance and redundancy for safety-critical operations

Higher uptime and reduced human intervention

According to FMI analysis, tightening safety standards and growing offshore automation are pushing vessel owners to upgrade from basic positioning solutions to higher-capability DPS architectures with integrated control and redundancy.

Technology Shift: From Standalone Control to Integrated Automation

The DPS market is undergoing a technology transition toward multi-sensor, automation-ready platforms. Suppliers are increasingly offering systems that combine navigation inputs, sensor fusion, and thrust control with vessel automation and power management software.

Key technology trends shaping procurement decisions include:

Advanced sensor fusion improving positioning accuracy

Integrated thrust and power optimization to reduce fuel consumption

Automation compatibility supporting unmanned and reduced-crew concepts

Cybersecurity has also emerged as a growing procurement factor, as DPS platforms become more tightly connected with digital ship systems and remote monitoring infrastructure.

Class 2 Systems Dominate High-Value Offshore Demand

By equipment type, Class 2 dynamic positioning systems are expected to account for 48.3% of global market share in 2026, reflecting their strong alignment with offshore certification and redundancy requirements.

Their dominance is driven by:

Dual fault tolerance suitable for mission-critical operations

Broad acceptance across offshore oil, gas, and wind projects

Ongoing upgrades in automatic backup switching and reliability

As offshore tasks grow more complex, Class 2 systems continue to strike the optimal balance between performance, safety, and cost efficiency.

Offshore Support Vessels Drive Application Growth

By application, platform supply vessels and offshore support vessels represent the largest demand segment, accounting for 37.4% of market share in 2026. These vessels rely heavily on dynamic positioning during approach, cargo transfer, and close-proximity operations.

Growth in this segment is reinforced by:

Increased offshore wind installation activity

Preference for flexible positioning over conventional mooring

Strong linkage between positioning accuracy, safety, and operational uptime

As offshore logistics intensify, dynamic positioning is becoming central to contractor performance metrics.

Power Systems Emerge as the Core Development Focus

From a component perspective, power systems command 46.1% of the market share, reflecting their critical role in DPS reliability and efficiency. Stable, redundant power delivery is fundamental to maintaining position under dynamic environmental loads.

Market demand is increasingly shaped by:

Diesel-electric and hybrid power architectures

Integration with electric propulsion systems

Energy optimization aligned with emissions compliance

These priorities are accelerating adoption of advanced power distribution and control technologies within DPS platforms.

Asia-Pacific Leads Growth, Europe and North America Sustain Momentum

Regional growth patterns highlight the global nature of DPS adoption:

Asia-Pacific is emerging as the fastest-growing hub, driven by shipbuilding expansion and offshore energy investment.

North America benefits from offshore wind development and deepwater safety mandates.

Europe continues to emphasize high-reliability systems aligned with emissions reduction and electric propulsion integration.

Country-level growth remains particularly strong in South Korea (12.8% CAGR), followed by the United States (12.3%), Norway (11.9%), China (11.6%), and Japan (11.1%).

Retrofit Demand and Regulatory Pressure Support Long-Term Growth

Beyond newbuild vessels, retrofit demand is expected to remain a major growth channel through 2036. Aging fleets are undergoing modernization programs to improve positioning accuracy, enhance safety compliance, and integrate automation-ready systems.

Regulatory frameworks emphasizing redundancy, automation readiness, and performance assurance are reinforcing investment in certified, high-reliability DPS solutions. While compliance raises development costs, it also strengthens barriers to entry and favors established suppliers.

Competitive Landscape: Integration and Service Reach Define Leadership

Competition in the dynamic positioning system market is shaped by technology differentiation, integration capability, and global service reach. Leading players including Kongsberg Maritime, Wärtsilä Group, ABB Marine Solutions, Rolls-Royce Marine, and General Electric Marine are investing heavily in control algorithms, sensor fusion, and modular system architecture.

Strategic partnerships with shipbuilders and offshore contractors are becoming increasingly important, enabling suppliers to embed DPS as part of broader vessel automation packages. Consolidation continues steadily, as manufacturers acquire sensor and component specialists to improve quality control and lifecycle cost performance.

Key Competitive Dynamics:

Strong focus on integrated vessel automation and modular DPS architectures

Rising partnerships with shipbuilders and offshore operators

Continuous investment in advanced control software and sensor technologies

Ongoing consolidation to improve quality control and lifecycle performance

Outlook: Dynamic Positioning Moves from Advantage to Requirement

By 2036, dynamic positioning systems will be viewed not as optional enhancements, but as baseline requirements for offshore and automation-ready vessels. As offshore operations move farther from shore and autonomy concepts mature, demand will increasingly favor systems that deliver precision, resilience, cybersecurity, and integration at scale.

With offshore energy, automation, and maritime safety converging, the dynamic positioning system market is positioned for sustained, high-value growth over the next decade.

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Dynamic Positioning System Market through 2035, Full Report Request: https://www.futuremarketinsights.com/reports/dynamic-positioning-system-market

Related Reports:

Dynamic Measurement System Market- https://www.futuremarketinsights.com/reports/dynamic-measurement-system-market

Dynamic Signal Analyzer Market- https://www.futuremarketinsights.com/reports/dynamic-signal-analyzer-market

Instrumentation Valve and Fitting Market-https://www.futuremarketinsights.com/reports/instrumentation-valve-and-fitting-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - [email protected]

For Media - [email protected]

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]